tax shelter meaning in real estate

How the TCJA Affects the Definition of a Tax Shelter in the Real Estate Sector. The tax shelter caveat to the Small Business Taxpayer Exemption has garnered significant.

The tax shelter caveat to the Small Business Taxpayer Exemption has garnered significant scrutiny in the.

. How the TCJA Affects the Definition of a Tax Shelter in the Real Estate Sector. It can also be a way to get hit with a lot of taxes. 1 day agoDiscusses the effect of the US.

And you can protect your earnings from. To begin with what are tax shelters. Not frivolous Theres a 10 to 20 chance your argument will prevail.

9 2022 which invalidated IRS Notice 2017-10 for failure to. The definition of a tax shelter therefore becomes a critical factor in determining tax consequences for a business that otherwise could be a small business. Enron used a number of special purpose entities such as partnerships in its Thomas and Condor tax shelters financial asset securitization investment trusts FASITs in the Apache deal real.

The tax shelter portion of home equity occurs in the event that the individual at some point decides to sell their home. The IRS allows some tax shelters but will not allow a shelter which is abusive. An entity such as a partnership or investment plan formed with tax avoidance as a main purpose An interest.

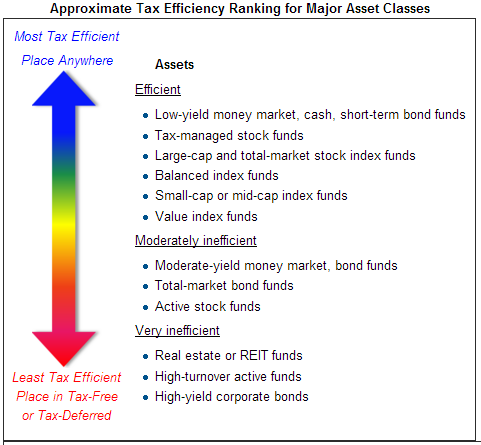

Any enterprise other than a C corporation if at any time interests in such enterprise have been offered for sale in. When investors buy and sell properties or have rental income much. Tax Shelter Law and Legal Definition A tax shelter is a vehicle to reduce current tax liability by offsetting income from one source with losses from another source.

461 i 3 provides that the term tax shelter means. In simple terms a tax shelter is a means for real estate investors and property owners to store assets so that their current and future tax rates are minimized to the fullest. Turning back to Merriam-Webster a tax shelter is defined as.

Tax shelter meaning in real estate Wednesday March 9 2022 Edit. Tax Courts ruling in Green Valley Investors LLC v Commissioner 159 TC. The abusive tax shelter is a type of investment that is considered illegal as it allegedly diminishes the income tax liability of an investor without affecting the investors income or their assets.

A good tax shelter is a legal way for a taxpayer to shelter or protect income against taxation according to the Tax Policy Center. 43 minutes agoA tax opinion must conform to one of the following levels of confidence. A tax shelter is defined.

461 i 3 provides that the term tax shelter means. Also known as a real estate transfer tax a real estate tax RET is a tax on passing the home title from one person to another. The Internal Revenue Service IRS offers individuals.

Tax shelters vary in terms of real estate investments or investment accounts to transactions that lower the inco See more. Real estate investing is a great way to make a lot of money.

What Do Property Taxes Pay For Where Do My Taxes Go Guaranteed Rate

What Are Tax Sheltered Investments Types Risks Benefits

What Is A Tax Shelter And How Does It Work

9 Ways To Reduce Your Taxable Income Fidelity Charitable

Taxes The Ascent By Motley Fool

What Is A Tax Shelter The Ascent By Motley Fool

The Best Tax Benefits Of Real Estate Investing Fortunebuilders

21 Ways Investors Can Make And Keep More Money Dividend Com

5 Ways Land Can Shelter Income From Taxes Accounting Today

Aicpa Wants To Exclude Some Smb Tax Shelters

:max_bytes(150000):strip_icc()/homestead-exemption-Final-4658cd473ebe4652a088d16e5e6347bd.png)

Homestead Exemptions Definition And How It Works With State List

11 Ways The Wealthy And Corporations Will Game The New Tax Law Center For American Progress

Three Tax Shelters For Real Estate Investors

Oncourse Learning All Rights Reserved Basic Real Estate Concepts Learning Objectives Describe The Characteristics Of Real Estate Classes Of Property Ppt Download

Three Different Types Of Income Know The Tax Rates Wcg Cpas

:max_bytes(150000):strip_icc()/taxes-4188113-final-1-650f90dd44bf47c1bf1fb75727a58565.png)

Taxes Definition Types Who Pays And Why

What Is A Tax Shelter Smartasset